The 30-Second Trick For Renters Insurance Portsmouth Nh

The longer you remain with some insurance firms, the reduced your costs can end up being, or the reduced your insurance deductible will certainly be. To understand if you have sufficient protection to change your possessions, make regular assessments of your most valuable items, also. According to John Bodrozic, co-founder of Home, Zada. a home upkeep application, "Many consumers are under-insured with the contents part of their plan because they have refrained a home stock and added the total worth to compare to what the plan is covering." Search for modifications in the area that might minimize rates, also.

When looking for an insurance carrier, below's a checklist of search and shopping ideas - home insurance New Hampshire. When it involves insurance, you want to make certain you are going with a company that is legitimate and creditworthy. Your primary step ought to be to see your state's Division of Insurance coverage internet site to learn the rating for every home insurance firm licensed to conduct company in your state, along with any type of consumer issues lodged versus the insurer

When looking for an insurance carrier, below's a checklist of search and shopping ideas - home insurance New Hampshire. When it involves insurance, you want to make certain you are going with a company that is legitimate and creditworthy. Your primary step ought to be to see your state's Division of Insurance coverage internet site to learn the rating for every home insurance firm licensed to conduct company in your state, along with any type of consumer issues lodged versus the insurerThe yearly premium is often what drives the choice to purchase a home insurance plan, yet do not look only at cost. "No two insurance providers utilize the exact same policy forms and endorsements, and plan phrasing can be extremely various," says Bank.

What Does Renters Insurance Portsmouth Nh Mean?

This might cost hundreds added a year," he keeps in mind. Financial institution urges customers to ask questions that give them a detailed sense of their alternatives: "You wish to consider various insurance deductible situations to finest consider if it makes good sense to go with a greater deductible and self-insure," he claims. The most common kinds are HO-1 (basic protection), HO-2 (broad coverage), HO-3 (unique form protection), and HO-5 (extensive protection).

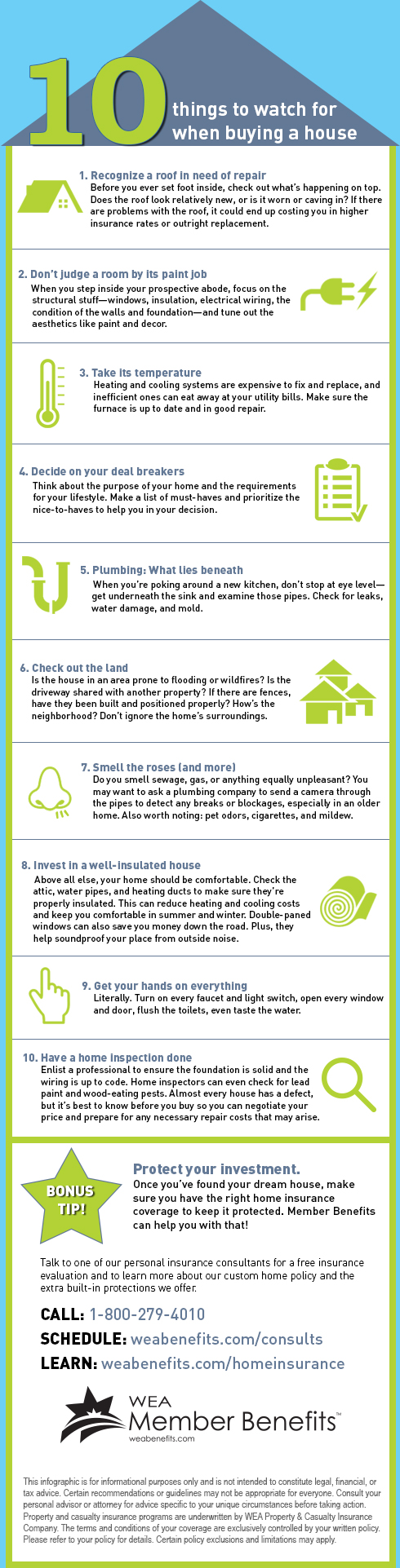

While a home insurance coverage assessment might sound daunting, it's in fact typical for insurance provider to request an inspection of your residential property while insuring your home. Home insurance coverage examinations are different than evaluations a property owner may do when buying a brand-new home. A home insurance coverage evaluation is started by the insurance business to evaluate the home's substitute cost and risks that might trigger future insurance cases.

Not everybody will certainly experience a home insurance assessment. They are more typical if you're purchasing an older home, buying a high-value home or you stay in an area that's prone to natural calamities, like wildfires or hurricanes. Insurance policy inspections are typically done at the beginning of a home owners insurance plan or at revivals.

If the assessment is just exterior, you do not require to be home, however you'll require to be there for an interior assessment. Criterion, in-person examinations evaluate the outside of your home. Usually, you would receive a letter in the mail letting you recognize an inspector will be pertaining to your residential or commercial property to take images.

Getting The Home Insurance Costs To Work

High-value homes generally need both an internal and exterior home insurance inspection. In this case, you would likely receive a call to schedule a time for the examiner to visit your home. insurance Portsmouth NH. You need to exist throughout this kind of evaluation, and an insurance policy examiner will never ever enter your home without your approval

In some cases, an insurer could supply an alternative for you to execute an electronic home insurance policy inspection. Some Grange home insurance policy customers can utilize our do it yourself Examination app to take images of their home utilizing their smartphone and send them straight and get a discount on their home insurance.

Learn more about use this link our, Home Insurance policy Every insurance coverage evaluation is various. Right here are some of one of the most common products on a home insurance policy examiner's checklist: The roof age and problem Exterior hazards such as overhanging trees that can bring about damage Exterior residential or commercial property such as lights or separate structures that might be harmed Water drainage systems exterior and interior Basement and structure HVAC system age and problem Chimneys and fire places Pipes systems Electric systems age and problem Home home appliances Walls and flooring Attic spaces and crawl rooms discover this info here Anti-theft systems such as a home safety and security system Smoke and carbon monoxide detectors Keeping your building and having ample insurance coverage is in the very best rate of interest for you and your insurance policy company.

Usually, these improvements will also improve the health, safety and security and wellness of you and your enjoyed ones, so they are worthwhile to go after for every person included. As a perk, if your home has specific safety and security functions, such as a home safety system, the home insurance coverage inspection might potentially help you make a discount rate on your home insurance.

Things about Buy Homeowners Insurance

The worst-case circumstance is that your residential or commercial property is deemed uninsurable due to the number of concerns discovered throughout the evaluation. In this case, an insurance policy inspection can trigger your home owners insurance to be cancelled or non-renewed. Furthermore, if you have a mortgage and your home insurance policy is cancelled, you could be at danger of force-placed insurance policy or repossession.

If you're having difficulty getting house owners insurance policy protection, you might need to try to find protection through an insurer that concentrates on risky properties or have your home covered under Fair Access Insurance Coverage Plans - home insurance Portsmouth NH. The cost can be more than a traditional home insurance plan, so it's suggested to check out one of these choices to insure your home after you have actually exhausted all other choices

In preparing this file we have actually trusted and presumed, without independent confirmation, the accuracy and efficiency of all information offered from public resources or which was provided to us or which was otherwise assessed by us. Past performance can not be an overview to future performance. 'l, Cl, Cl' and the 'I-man' logo are the trademarks and residential or commercial property of l, CICl Bank.

In preparing this file we have actually trusted and presumed, without independent confirmation, the accuracy and efficiency of all information offered from public resources or which was provided to us or which was otherwise assessed by us. Past performance can not be an overview to future performance. 'l, Cl, Cl' and the 'I-man' logo are the trademarks and residential or commercial property of l, CICl Bank.

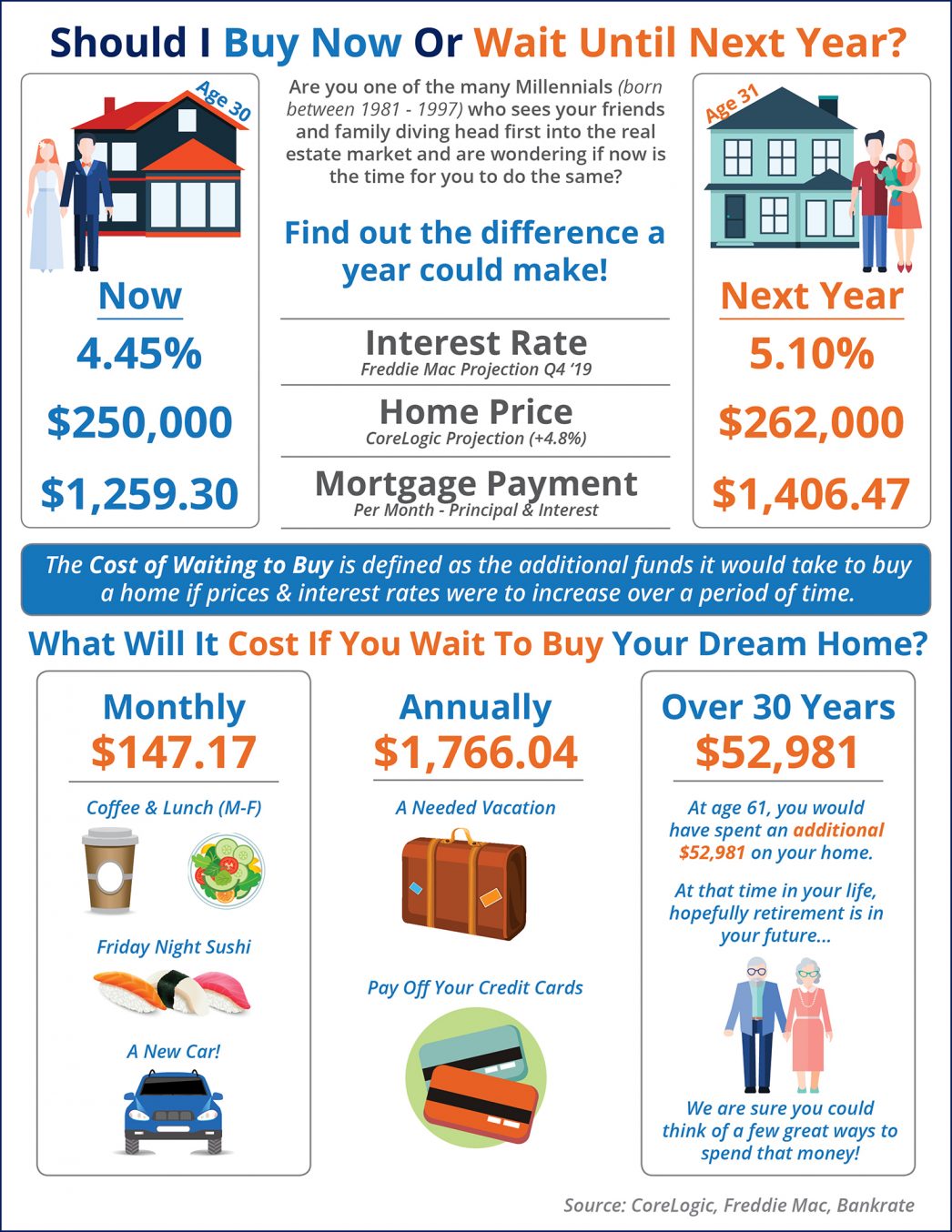

Getting a new house is amazing, whether you're a

Getting a new house is amazing, whether you're a  This implies you don't have to pay your premium (your homeowners insurance coverage settlement) in a lump amount every year. Insurer supply a broad range of property insurance coverage kinds, from

This implies you don't have to pay your premium (your homeowners insurance coverage settlement) in a lump amount every year. Insurer supply a broad range of property insurance coverage kinds, from

When seeking an insurance coverage provider, below's a list of search and buying tips - insurance agency Portsmouth NH. When it involves insurance, you want to make certain you are selecting a carrier that is genuine and creditworthy. Your primary step needs to be to see your state's Department of Insurance policy site to discover the ranking for each home insurer licensed to conduct organization in your state, along with any kind of customer issues lodged against the insurer

When seeking an insurance coverage provider, below's a list of search and buying tips - insurance agency Portsmouth NH. When it involves insurance, you want to make certain you are selecting a carrier that is genuine and creditworthy. Your primary step needs to be to see your state's Department of Insurance policy site to discover the ranking for each home insurer licensed to conduct organization in your state, along with any kind of customer issues lodged against the insurer

This implies you don't have to pay your costs (your property owners insurance settlement) in a lump sum every year. HO-1 normally offers you much more barebones coverage, while HO-5 insurance policy will certainly provide you the most extensive protection readily available.

This implies you don't have to pay your costs (your property owners insurance settlement) in a lump sum every year. HO-1 normally offers you much more barebones coverage, while HO-5 insurance policy will certainly provide you the most extensive protection readily available.